Nutritive Sweetener Market Size to Exceed USD 37.97 Billion by 2035 | Towards FnB

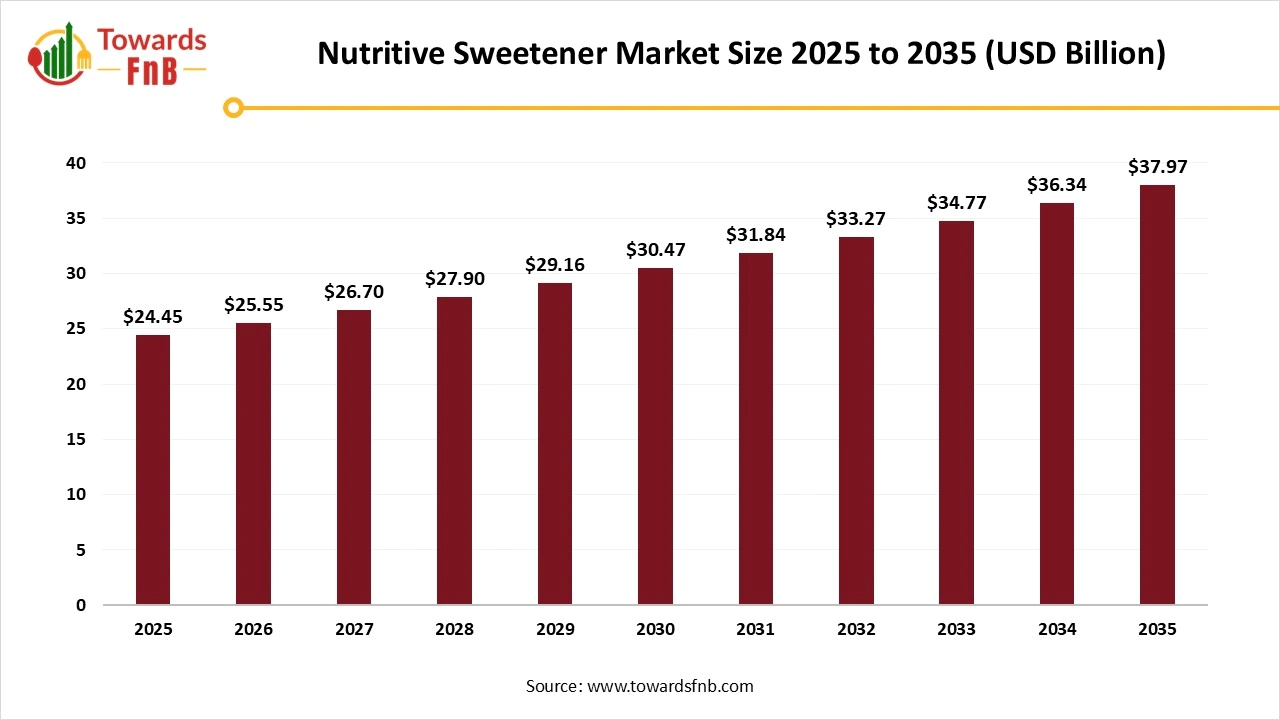

According to Towards FnB, the global nutritive sweetener market size is evaluated at USD 25.55 billion in 2026 and is projected to grow significantly, reaching USD 37.97 billion by 2035. This growth represents a CAGR of 4.5% during the forecast period of 2026 to 2035. The surge in demand for healthier, natural alternatives to sugar is one of the major catalysts behind this steady market expansion, as more consumers prioritize nutritional choices.

Ottawa, Feb. 02, 2026 (GLOBE NEWSWIRE) -- The global nutritive sweetener market size stood at USD 24.45 billion in 2025 and is predicted to grow from USD 25.55 billion in 2026 to reach around USD 37.97 billion by 2035, as reported by Towards FnB, a sister firm of Precedence Research. As consumers increasingly seek sweeteners that offer lower caloric content and natural sourcing, innovations in plant-based sweeteners are gaining momentum, helping to meet these evolving needs.

The increasing health consciousness is the key factor driving market growth. Also, technological innovations in plant-based sweeteners, coupled with the rapid urbanization across the globe, can fuel market growth further.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/6001

A New Era of Sweeteners: Meeting Consumer Demand for Healthier Alternatives

The increasing health consciousness is the key factor driving market growth. As more consumers seek healthier, plant-based alternatives, the demand for low-calorie and natural sweeteners like monk fruit and stevia is accelerating. Technological innovations in plant-based sweeteners, coupled with the rapid urbanization across the globe, can fuel market growth further.

Key Highlights of Nutritive Sweetener Market

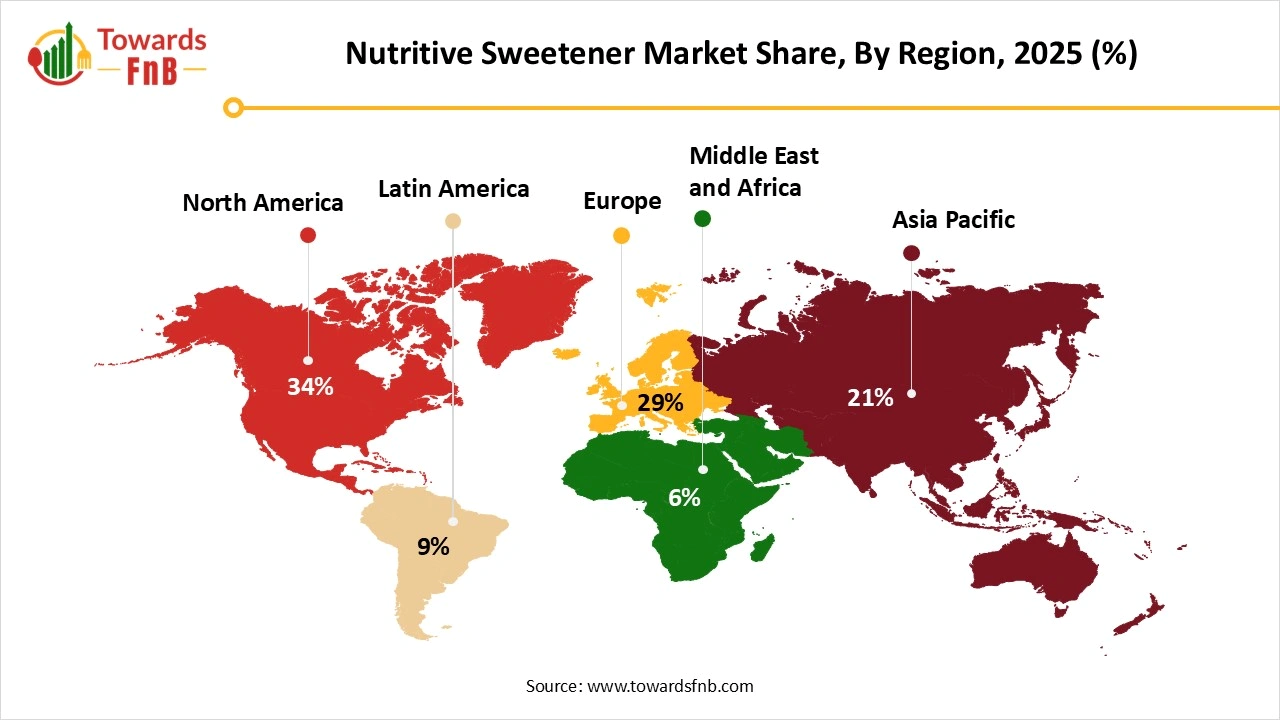

- By region, North America led the nutritive sweetener market with largest share of 34% in 2025, whereas the Asia Pacific is expected to be the fastest-growing region in the foreseeable period.

- By product type, the fructose segment dominated the market with the largest share in 2025, while the sucrose segment is expected to grow at the fastest CAGR over the forecast period.

- By nature, the conventional segment held the largest market share in 2025, while the organic segment is expected to grow at the fastest CAGR over the forecast period.

- By end use, the food processing segment dominated the market with the largest share in 2025, whereas the household/retail segment is expected to grow at the fastest CAGR during the projected period.

- By distribution channel, the store-based retail segment dominated the market with the largest market share in 2025, while the indirect sales segment is expected to grow at the fastest CAGR during the projected period.

Surge in Health Awareness Among Consumers Is Helpful for the Growth of the Nutritive Sweetener Market

The surge in health awareness among the majority of consumers across the globe is the latest trend in the market. Market players are increasingly launching and advancing new sweetening solutions that are tailored to changing consumer preferences. These cutting-edge sweeteners, like monk fruit extracts, are rapidly gaining acceptance as they are perceived as healthier alternatives to conventional sugar.

The Ongoing Integration of Organic Sourcing Methods Is Helpful for the Growth of the Market

Many market players are increasingly adding sustainable agricultural practices to improve farmer livelihoods and ensure detailed supply chain transparency through traceability technologies and advanced systems. Also, major companies are creating organic, nutritive sweetener portfolios by enforcing ethical agriculture collaboration with farmers.

Impact of AI in the Nutritive Sweetener Market

Artificial intelligence is increasingly being applied across the global nutritive sweetener market to improve formulation precision, process efficiency, and consistency across applications such as beverages, bakery, confectionery, dairy, and processed food. Machine learning models analyze variability in raw materials, including sugarcane, sugar beet, corn, and tapioca, to predict conversion efficiency, sweetness intensity, and impurity profiles during refining and enzymatic processing, enabling tighter control over product specifications across regions.

In product development, AI supports sweetness and functionality modeling by predicting how nutritive sweeteners such as sucrose, glucose syrups, fructose syrups, and maltodextrin interact with acids, flavors, and texturizers under different thermal and pH conditions, reducing formulation trial cycles. During manufacturing, AI-driven process control systems monitor crystallization behavior, evaporation rates, viscosity, and color development to minimize yield losses and batch variability at an industrial scale.

AI is also applied in shelf-life and logistics optimization, where predictive analytics assess risks related to caking, hygroscopicity, browning, and microbial stability during long-distance storage and international distribution. From a quality and regulatory perspective, AI assists in specification harmonization, compositional verification, and labeling alignment by mapping product attributes against international food safety and nutrition standards referenced by the Food and Agriculture Organization and the Codex Alimentarius Commission.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/nutritive-sweetener-market

Recent Developments in the Nutritive Sweetener Market

- In October 2025, Coca-Cola started to roll out bottles of its soda containing cane sugar in the U.S. The company also highlights that the new recipe was "designed to complement" its current product range, not replace it wholly.

New Trends in the Nutritive Sweetener Market

- Market players are rapidly introducing organic, traceable variants of nutritive sweeteners like Tate & Lyle's organic fructose line, which directly increases the demand for organic ingredients.

- Cutting-edge fermentation and biosynthesis methods are being utilized to create highly pure stevia and sucrose stems, minimizing land use and enhancing overall production efficiency.

- Large-scale manufacturers are heavily investing in regenerative farming for cane sugar to fulfill eco-aware certifications and tackle climate-associated crop yield risks.

Product Survey of the Nutritive Sweetener Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Sucrose | Disaccharide sweetener providing sweetness, bulk, and functional properties | Refined white sugar, brown sugar | Beverages, bakery, confectionery | Food-grade cane and beet sugar |

| Glucose Syrups | Starch-derived sweeteners offering sweetness, viscosity, and humectancy | DE 20–42 syrups | Confectionery, beverages, processed foods | Corn-based glucose syrups |

| Fructose | High-intensity nutritive sweetener with strong sweetness profile | Crystalline fructose, liquid fructose | Beverages, bakery, dairy | Food-grade fructose |

| High-Fructose Corn Syrup | Liquid sweetener blending glucose and fructose for cost-effective sweetness | HFCS 42, HFCS 55 | Soft drinks, processed foods | HFCS sweetener systems |

| Honey | Natural nutritive sweetener with flavor and humectant properties | Liquid honey, dried honey powders | Bakery, beverages, sauces | Natural honey ingredients |

| Maple Syrup | Natural sweetener derived from maple sap with distinct flavor | Grade A syrups | Premium foods, beverages | Maple syrup sweeteners |

| Molasses | Byproduct of sugar refining providing sweetness and color | Blackstrap, light molasses | Bakery, sauces, animal feed | Molasses sweetening agents |

| Malt Extracts | Sweeteners derived from malted grains with fermentable sugars | Liquid and dried malt extracts | Bakery, brewing, cereals | Malt extract sweeteners |

| Invert Sugar | Hydrolyzed sucrose offering enhanced sweetness and moisture retention | Liquid invert syrups | Confectionery, bakery | Invert sugar syrups |

| Syrup Blends | Customized blends combining multiple nutritive sweeteners | Application-specific blends | Beverage and food manufacturers | Customized nutritive sweetener blends |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/6001

Nutritive Sweetener Market Dynamics

What are the Growth Drivers of the Nutritive Sweetener Market?

The rising consumption of plant-based products, boosted by a surge in awareness among consumers regarding environmental and health benefits associated with this diet, is a major driver impacting positive market growth. Also, major market players are working towards producing the latest plant-based sweeteners, which can mimic the functionality and taste of conventional sweeteners like sugar or corn syrups.

Intense Competition from Alternatives Hampering the Growth of the Nutritive Sweetener Market

The growing competition from substitute sweeteners is the major factor hindering market growth. Consumers are aware of "processed" sugars, increasingly preferring organic and natural sweeteners such as stevia and monk fruit. Moreover, technological innovations in precision fermentation are enabling the manufacturing of low-calorie sugars that copy the properties of sucrose without any caloric load.

Ethanol Blending Programs are Creating Lucrative Opportunities in the Market

The major sugarcane manufacturing nations are rapidly advancing sugarcane supply chains to fulfill the food and fuel demand. Governments in these countries are also supporting ethanol blending by investing in better storage, logistics, crushing capacity, and quality systems. This helps the food sector to enhance the supply of liquid sweeteners, refined sugar, and sugar-derived ingredients utilized in dairy, bakery, and sauces.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Nutritive Sweetener Market Regional Analysis

North America Led the Nutritive Sweetener Market in 2025

North America dominated the nutritive sweetener market in 2025. The dominance of the region can be attributed to the increasing health awareness and growing need for plant-based, low-calorie alternatives. In addition, food and beverage market players are reformulating products with sweeteners to fulfill consumer demand for sugar-reduced and healthier options, leading to market growth.

Asia Pacific Is Observed to Be the Fastest-Growing Region in the Foreseeable Period

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to ongoing urbanization and major shifts in lifestyles, which lead to a growing prevalence of diabetes, obesity, and other chronic disorders. Furthermore, growing countries in the region, such as India and China, are witnessing a major shift towards Western dietary patterns, propelling demand for sweeteners.

Europe is Observed to Have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to a rise in demand for natural & clean label options, coupled with the increasing health awareness, especially in emerging economies in the region. Additionally, the consumers in Europe mainly prefer products with transparency and simple ingredient lists and are generally willing to spend more money on natural sweeteners like stevia over synthetic options.

Trade Analysis for the Nutritive Sweetener Market

What Is Actually Traded (Product Forms and HS Proxies)

- Refined sucrose (table sugar) the most widely consumed nutritive sweetener derived from sugarcane or sugar beet — is traded globally under HS codes in Chapter 17, particularly HS 1701 for raw cane or beet sugar, and HS 1702 for glucose, fructose, and syrup products that serve as sweeteners. These codes cover crystalline and syrup forms of nutritive sweeteners used in food and beverage formulation.

- Glucose syrup and fructose syrup varieties (including high-fructose corn syrup, glucose-fructose syrup, and other nutritive syrup sweeteners) are classified under HS 170230, HS 170240, and HS 170260 depending on composition and fructose content. These syrups are significant industrial sweeteners in soft drinks, confectionery, and processed foods.

-

Nutritive sweetener blends and specialty sugar preparations used as finished ingredients in foods may be declared under HS 21069099 when combined with other food components, reflecting composite food preparations that include sweetening matters.

Natural syrups (e.g., maple syrup, honey blends) used as nutritive sweeteners may also use HS classifications in Chapter 17 or be part of Chapter 21 mixed food preparations where appropriate. - Packaging materials (bags, drums, containers) accompany shipments of sweeteners and are usually classified separately under HS 3923 or HS 4819 and not counted in core product totals.

Top Exporters (Supply Hubs)

- Brazil: One of the world’s largest sugar producers and exporters, supplying refined cane sugar and related sweetening products into global markets.

- India: A leading exporter of sugar and fructose syrup products, driven by high domestic agricultural output from both sugarcane and beet sources.

- European Union (notably France, Netherlands, and Spain): Major exporters of sugar and syrup sweeteners within and beyond European markets, supported by strong agricultural and refining capacity.

- Thailand: Large producer and exporter of sugar and nutritive sweetener derivatives used in regional beverage and confectionery industries.

-

United States: Prominent exporter of corn-derived nutritive sweeteners (including high-fructose and glucose syrups) benefiting from extensive corn processing infrastructure.

Top Importers (Demand Centres)

- European Union: A collective major importer of sugar and fructose/glucose syrups to support food processing, beverage production, and confectionery sectors.

- China: Large importer of both refined sugar and corn-derived syrup sweeteners to satisfy rapidly growing food and beverage manufacturing demand.

- United States: Substantial importer of specific nutritive sweeteners (including sustainable and specialty syrups) despite significant domestic production, due to diverse industry requirements.

- Japan: Imports refined sugars and nutritive syrups for food processing, confectionery, and beverage manufacturing.

-

Middle East & North Africa (e.g., UAE, Morocco): Growing import demand driven by expansion of food processing and retail sweetened products.

Typical Trade Flows and Logistics Patterns

- Bulk sugar and syrup shipments typically move via containerized sea freight from production hubs in the Americas, Asia, and Europe to major demand centres.

- Temperature-stable nutritive sweeteners do not generally require special climate-controlled logistics, making sea freight the predominant mode.

- High-value refined sugar products or specialty syrups for premium or niche markets may be transported by air freight when time-sensitivity or small shipment size is critical.

- Regional distribution centres often consolidate imports and repack for local food industry customers and retail networks.

Trade Drivers and Structural Factors

- Global food and beverage growth — particularly in soft drinks, confectionery, and processed foods — sustains demand for nutritive sweeteners across regions.

- Price competitiveness of syrup sweeteners vs crystalline sugar influences sourcing decisions; for example, high-fructose corn syrups often cost less than refined sugar in some markets.

- Agricultural output dynamics (e.g., sugarcane/beet harvests) and associated trade policies affect export availability and pricing.

- Clean-label and natural ingredient trends stimulate demand for certain nutritive sweeteners (e.g., “natural” syrups or less processed sugars) alongside conventional sources.

-

Trade agreements and tariff regimes shape cost structures and the competitiveness of different exporting regions.

Regulatory, Quality, and Market-Access Considerations

- Nutritive sweeteners must comply with food safety and ingredient regulations in importing markets, including permissible additive use and labeling standards.

- HS classification accuracy (e.g., distinguishing between HS 1701/1702 vs HS 21069099) affects tariff treatment and documentation requirements during customs clearance.

- Importers often need certificates of origin, sanitary documentation, and phytosanitary statements for sugar and syrup products.

- Some regions restrict or impose quota systems on sugar imports to protect domestic producers.

Government Initiatives and Public-Policy Influences

- Agricultural support policies (e.g., subsidies for sugarcane or corn production) influence global production volumes and trade flows for nutritive sweeteners.

- Nutrition labeling legislation shapes product formulation and market access, pushing manufacturers to declare sugar content transparently.

-

Trade facilitation agreements and tariff harmonization can reduce barriers and influence sourcing decisions for sugar and syrup sweeteners.

Nutritive Sweetener Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 4.5% |

| Market Size in 2026 | USD 25.55 Billion |

| Market Size in 2027 | USD 26.70 Billion |

| Market Size in 2030 | USD 30.47 Billion |

| Market Size by 2035 | USD 37.97 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Nutritive Sweetener Market Segmental Analysis

Product Type Analysis

Why Did the Fructose Segment Dominate the Market in 2025?

The fructose segment dominated the market with the largest share in 2025. The dominance of the segment can be attributed to the rising need for low-calorie and natural sugar alternatives, along with its high sweetening intensity. In addition, fructose is extensively utilized in dairy products, beverages, and other baked goods because of its capacity to enhance color, texture, and flavor.

The sucrose segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to its crucial economic, functional, and sensory properties, coupled with the extensively expanding packaged food industry. Sucrose is generally used as an additive in pharmaceutical products, like chewable tablets, syrups, and lozenges, to improve their palatability.

Nature Analysis

How Did the Conventional Segment Hold the Largest Share in the Market for Nutritive Sweeteners?

The conventional segment held the largest market share in 2025. The dominance of the segment can be linked to the rapid urbanization, growing demand for packaged foods, and busy lifestyles in the major cities. Conventional sweeteners, including HFCS and sugar, are favored by major market players because of their scalability and cost-effectiveness compared to conventional sweeteners.

The organic segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a rising preference for clean-label products and a surge in the need for sustainable sourcing. Furthermore, market players are extending their portfolios to include syrups, organic sugar, and other solutions to cater to evolving tastes.

End-Use Analysis

Why Did the Food Processing Segment Dominate the Market in 2025?

The food processing segment dominated the market with the largest share in 2025. The dominance of the segment is owing to ongoing urbanization and extensive applications in bakery, beverages, and confectionery. Nutritive sweeteners are crucial beyond just offering flavor; they are necessary for improving mouthfeel, texture, and color by strengthening shelf stability.

The household/retail segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to a surge in health-aware consumers and a rise in household incomes in emerging nations such as India and China. Moreover, market players are launching product variations, like organic and smaller packaging formats, leading to segment growth soon.

Distribution Channel Analysis

How Did the Store-Based Retail Segment Lead the Market in 2025?

The store-based retail segment led the market with the largest market share in 2025. The dominance of the segment can be attributed to the growing demand for organic and natural alternatives, coupled with the growth of the cooking and home banking sector. In addition, retailers are providing an extensive range of specialized sweeteners, which allow for higher profit rates.

The indirect sales segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the increasing consumer demand for household and retail products, along with the growth of the e-commerce sector. Furthermore, the ongoing expansion of online retail has made it convenient for natural nutritive sweeteners to reach consumers directly.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

-

Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Top Companies Driving Innovation in the Nutritive Sweetener Industry

- Tate & Lyle: Tate & Lyle is a global leader in providing innovative, healthier sweeteners like organic and non-GMO options. Known for its commitment to sustainability, the company focuses on reducing environmental impact and advancing regenerative agriculture practices. Tate & Lyle also expanded its portfolio through the acquisition of Fortitech, offering a broader range of sweetening solutions.

- Cargill: Cargill is a major player in the nutritive sweetener market, offering products like glucose syrups and HFCS. The company is committed to sustainability and responsible sourcing, with efforts to reduce environmental impact and support farmers. Cargill also innovates in low-calorie and plant-based sweeteners to cater to the growing demand for healthier alternatives.

- Japan Corn Starch Co.: Japan Corn Starch Co. specializes in starch-based sweeteners like glucose and HFCS, with a strong presence in the Asia-Pacific market. The company is investing in advanced fermentation and enzyme technologies to stay competitive. With the rise of processed foods in Asia, JCST is expanding production capacity to meet growing demand.

- COFCO International: COFCO International, part of China's COFCO Corporation, produces a range of corn-based sweeteners like glucose syrups and HFCS. The company is focused on sustainable sourcing and has embraced traceability technology to ensure transparency in its supply chain. COFCO is expanding its global presence and capitalizing on demand for sweeteners across diverse markets.

Segments Covered in the Report

By Product Type

- Fructose

- Sucrose

- Corn Sugar

- Honey

- High Fructose Corn Syrup

By Nature

- Organic

- Conventional

By End Use

- Household/Retail

- Food Processing

- Bakery

- Confectionery

- Beverages

- Pharmaceuticals

By Distribution Channel

- Direct sales

- Indirect sales

- Store-based Retailing

- Hypermarket/Supermarket

- Convenience Store

- Discount Store

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/6001

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.