Global Hydrogen Energy Storage Market to Reach USD 89.32 Billion by 2032 at a 4.58% CAGR

Asia Pacific Leads Hydrogen Energy Storage Market as Industry Nears USD 89.32 Billion by 2032

Asia Pacific Leads Hydrogen Energy Storage Market as Industry Nears USD 89.32 Billion by 2032 | Hydrogen energy storage is rapidly evolving into a critical enabler of long-duration energy storage”

PUNE, MAHARASHTRA, INDIA, February 4, 2026 /EINPresswire.com/ -- Hydrogen Energy Storage Market Outlook Gains Momentum Worldwide— Fortune Business Insights

The global hydrogen energy storage market 2026 is emerging as a critical pillar of the global energy transition, enabling long-duration, flexible, and low-carbon energy storage solutions. As countries accelerate the deployment of renewable energy and commit to net-zero targets, hydrogen energy storage is gaining prominence for balancing intermittent power generation and decarbonizing hard-to-abate sectors.

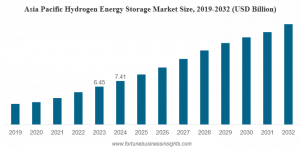

According to Fortune Business Insights, the global hydrogen energy storage market was valued at USD 16.94 billion in 2024 and grew to USD 20.86 billion in 2025. The market is projected to reach USD 89.32 billion by 2032, exhibiting strong growth over the forecast period. Asia Pacific dominated the market in 2024 with a 43.74% share, supported by national hydrogen strategies, large-scale electrolyzer deployment, and expanding industrial demand.

Get Sample Report PDF:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/hydrogen-energy-storage-market-102755

Market Snapshot: Hydrogen Energy Storage Market 2026

Market Value (2024): USD 16.94 Billion

Market Size (2025): USD 20.86 Billion

Forecast Market Value (2032): USD 89.32 Billion

Key Growth Phase: 2026 onward driven by grid-scale projects

Leading Technology: Compressed Gas Storage

Dominant Form: Gaseous Hydrogen

Key End User: Industrial

Largest Region: Asia Pacific

Market Overview: Hydrogen as a Long-Duration Energy Storage Solution

Hydrogen energy storage enables surplus electricity—primarily from renewable sources such as wind and solar—to be converted into hydrogen through electrolysis. This hydrogen can be stored for extended periods and later used for power generation, industrial processes, or transportation fuel. Unlike conventional batteries, hydrogen storage supports long-duration and seasonal energy storage, making it highly valuable for future energy systems with high renewable penetration.

In the global hydrogen energy storage market 2026, hydrogen is increasingly positioned as both an energy carrier and a storage medium that enhances grid stability, energy security, and decarbonization across multiple sectors.

Key Market Drivers Supporting Expansion

Rising Adoption of Renewable Energy

The rapid growth of renewable energy is a primary driver of hydrogen energy storage demand. Solar and wind generation are inherently variable, creating periods of surplus electricity that cannot always be consumed in real time. Hydrogen storage addresses this challenge by converting excess renewable power into a storable fuel, ensuring that clean energy is not curtailed.

As governments worldwide scale renewable capacity and target higher shares of clean electricity, hydrogen energy storage is becoming essential for balancing supply and demand and maintaining grid reliability.

Decarbonization Across Industrial and Transport Sectors

The global push to decarbonize heavy industries and transportation is another major growth driver. Sectors such as steel, cement, chemicals, and long-haul transport require high energy density fuels that are difficult to electrify directly. Hydrogen energy storage enables the production and storage of green hydrogen that can be deployed when needed, supporting emission reductions in these sectors.

This flexibility positions hydrogen storage as a cornerstone technology in achieving national and international climate goals.

Market Restraints Impacting Adoption

High Production and Storage Costs

Despite its advantages, hydrogen energy storage faces cost-related challenges. Producing green hydrogen via electrolysis remains more expensive than conventional fossil-based hydrogen. Additionally, infrastructure requirements—including high-pressure tanks, liquefaction systems, and underground storage—require substantial capital investment.

Until technological advancements and economies of scale significantly reduce costs, financial barriers will continue to influence the pace of adoption in the global hydrogen energy storage market 2026.

Emerging Market Opportunities

Seasonal and Long-Duration Energy Storage

Hydrogen offers a unique opportunity for seasonal energy storage, a capability that conventional batteries struggle to provide. Hydrogen can be stored for months in underground caverns or large-scale tanks and used during periods of low renewable generation or peak demand.

Countries with high renewable penetration are increasingly exploring hydrogen storage to ensure year-round energy security, making this application a major growth opportunity for the market.

Hydrogen Energy Storage Market Trends

Expansion of Utility-Scale Hydrogen Projects

A defining trend in the market is the shift from pilot projects to large-scale hydrogen hubs and storage systems. Governments and private investors are funding integrated hydrogen ecosystems that combine production, storage, and end-use applications.

These large-scale initiatives highlight hydrogen’s growing role as a strategic energy asset rather than a niche technology, accelerating commercialization across regions.

Segmentation Insights

By Technology

Compressed Gas Storage dominates due to technological maturity and widespread adoption

Liquid Hydrogen Storage is the fastest-growing segment, driven by high energy density needs

By Form

Gaseous Hydrogen leads due to simpler infrastructure and lower costs

Liquid Hydrogen is expanding rapidly for space-constrained and high-demand applications

By End User

Industrial sector dominates, driven by decarbonization needs in steel, chemicals, and refining

Utilities and Grid Operators represent the fastest-growing segment, leveraging hydrogen for long-duration storage and grid balancing

Regional Outlook

Asia Pacific

Asia Pacific leads the hydrogen energy storage market, supported by strong government policies, industrial demand, and large-scale investments in hydrogen infrastructure. China, Japan, South Korea, and Australia are key contributors to regional dominance.

North America

North America is witnessing rapid growth, driven by federal funding programs, hydrogen hub initiatives, and strong private-sector participation, particularly in the U.S.

Europe

Europe remains a major market due to stringent decarbonization targets, early adoption of electrolyzers, and pilot underground hydrogen storage projects.

Middle East & Africa

The region is gaining strategic importance with large green hydrogen export projects and abundant renewable resources, positioning it as a future hub for hydrogen production and storage.

Latin America

Latin America shows growing potential, led by countries investing in renewable-based hydrogen strategies and export-oriented projects.

Competitive Landscape

The hydrogen energy storage market is characterized by active innovation and strategic partnerships. Companies are focusing on improving electrolyzer efficiency, reducing storage costs, and integrating hydrogen solutions across power, industrial, and mobility applications.

Key Companies Include

Linde plc

Air Liquide

Air Products & Chemicals, Inc.

ENGIE

Plug Power Inc.

ITM Power

Nel Hydrogen

Chart Industries

Technology advancement, scale-up of infrastructure, and cross-sector collaboration remain central to competitive positioning.

Get Sample Report PDF:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/hydrogen-energy-storage-market-102755

About Us

Fortune Business Insights provides in-depth market research and actionable intelligence to help businesses navigate industry transformation, uncover new opportunities, and make informed strategic decisions.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.